The Evolution of the Digital Agri Hub Dashboard (Phase II): Regional Deployments & Emerging Insights

The Evolution of the Digital Agri Hub Dashboard (Phase II): Regional Deployments & Emerging Insights

Author: Inder Kumar

Publish Date: 22 May 2024

The Digital Agriculture (D4Ag) landscape is undergoing rapid developments, generating transformative effects on global development across environmental, social, economic, and food security domains. At the forefront of tracking these developments and assessing the impact created by digital solutions lies the role of Digital Agri Hub. In 2022, the Hub reached a significant milestone, showcasing its dashboard offering transparent insights into D4Ag and digital innovations deployed in low- and middle-income countries (LMICs). This has marked a crucial step in the digitalisation of agriculture, providing a global perspective on digital innovations across various aspects such as production, market access, financial inclusion, and supply chain. Moving into the second phase of its development, the Digital Agri Hub’s dashboard has witnessed a substantial increase, with over 1200 digital solutions by 2024. This growth can be attributed to increased data contributors and the introduction of a new data entry tool for digital solution providers, streamlining the listing of entries on the hub’s dashboard. Consequently, the platform now spotlights curated and verified entries enhancing their visibility and credibility. This article delves into the emergence of digital solutions between 2019 and 2023, shedding light on market reforms, and regional variations, and offering a glimpse into the future trajectory of the D4Ag landscape by 2024.

Navigating the landscape of growing digital innovations for sustainable growth

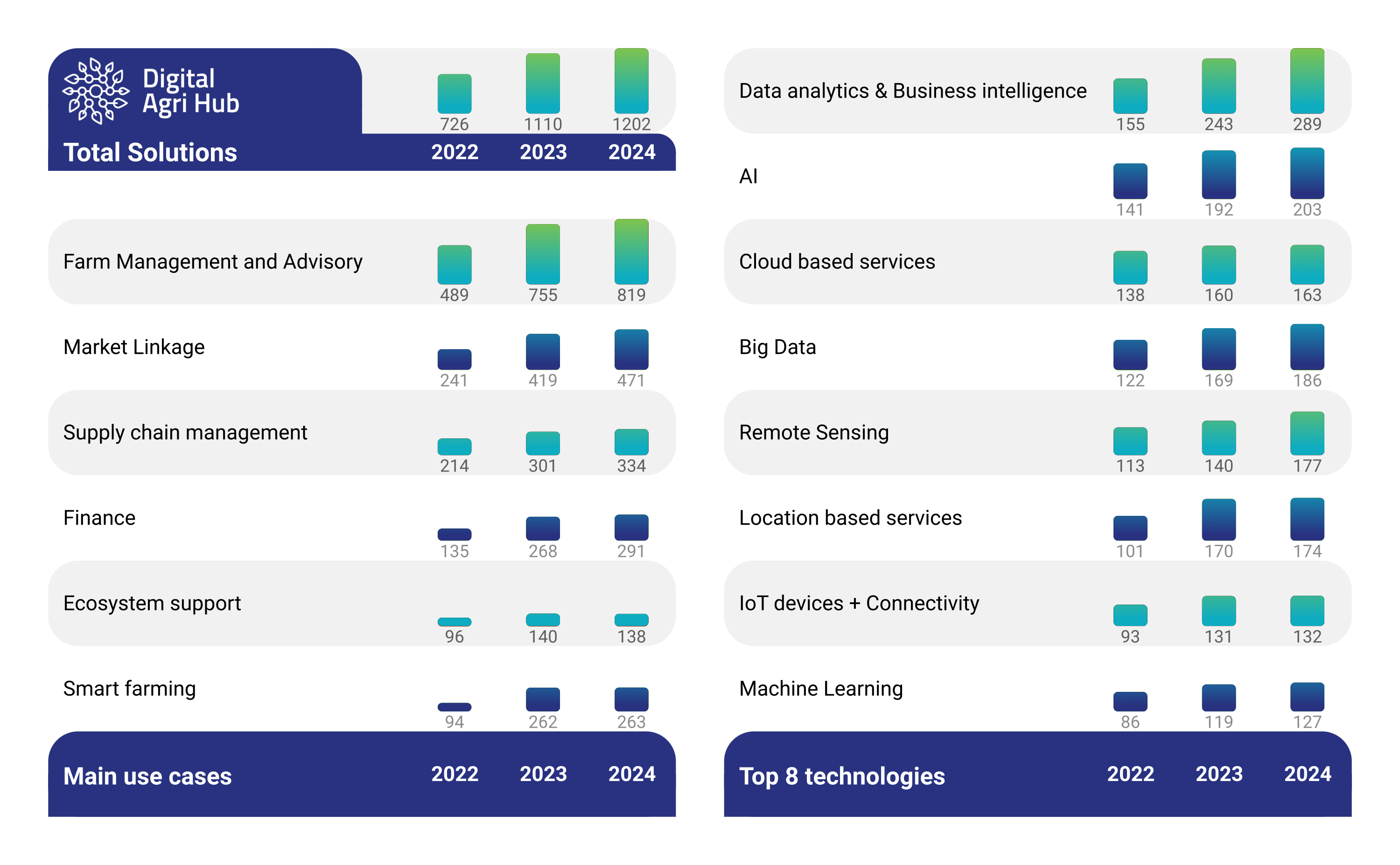

Figure 1: Growing digital innovations deployed in low and middle-income countries.

The journey of Digital Agri Hub’s dashboard began in September 2021, building upon the foundation laid by the Digitalisation of African Agriculture Report 2018-2019, published by the Technical Centre for the Agriculture and Rural Cooperation (CTA), which initially documented 320 solutions deployed across the continent. By 2022, as illustrated in Figure 1, the dashboard had grown significantly to 726 active digital solutions deployed across LMICs, offering comprehensive global coverage. These self-reported and collaboratively curated solutions enabled platform users to generate tailored insights for their respective countries, use cases, and digital technologies. However, the ability to generate insights with a multi-country or regional focus was initially limited. Recognising this, the platform underwent significant technical upgrades in 2023, allowing users to select several individually selected countries (FAO SOFA regions) for insights with a broader geographical scope.

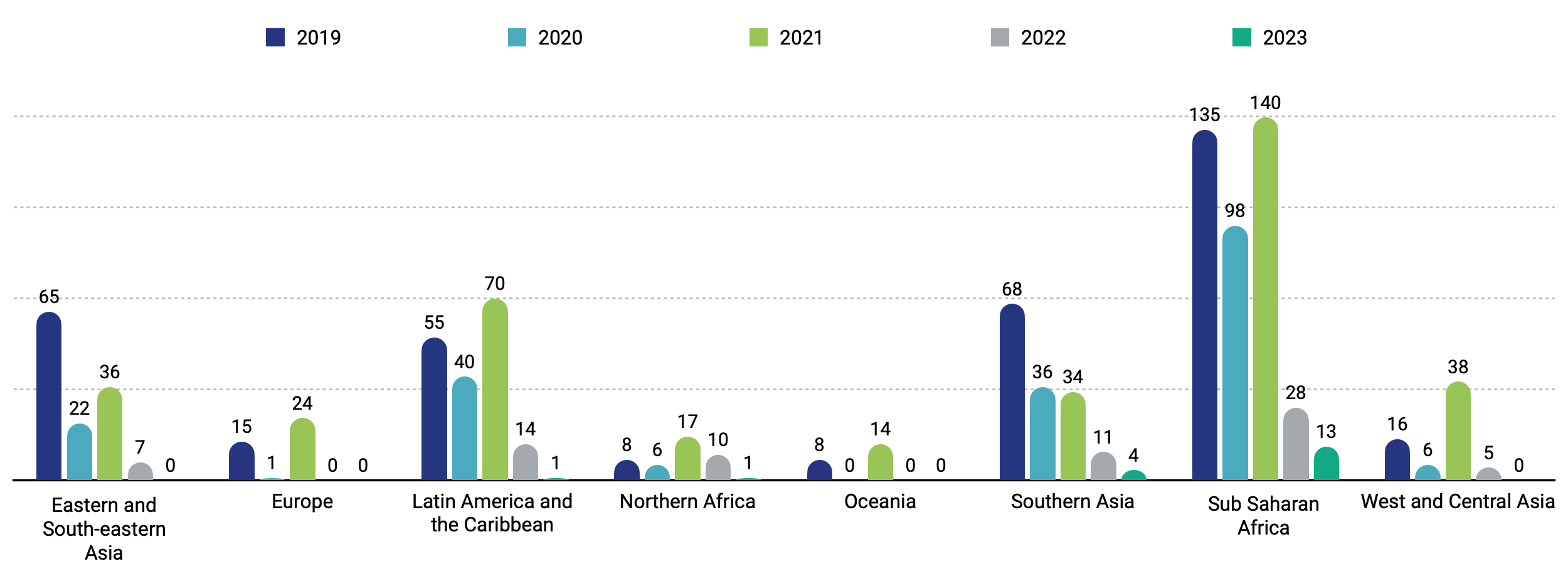

This enhancement revealed dynamic shifts in deployment patterns across regions over the past five years, with Sub-Saharan Africa leading with 414 deployments and Oceania trailing with only 22 deployments (Figure 2). These insights prompt critical questions about the (non)sustainable growth of D4Ag across regions: Is the high deployment rate in Sub-Saharan Africa a result of pioneering studies such as the one done by CTA or of ample financial support from donor organisations? What factors contribute to the relatively lower attractiveness of donor organisations of investing in D4Ag in regions such as Oceania, Northern Africa, and Western and Central Asia? How does the size of the rural population engaged in agriculture impact the attractiveness of investing in D4Ag in such regions, considering the contribution of agriculture to the country’s GDP? Are regional deployment disparities influenced by geopolitical dynamics, language barriers, or time zone differences? And to what extent do climate change and global warming impact the commercial appeal of agriculture investments, particularly in regions with relatively less digital solutions deployed such as Oceania, Northern Africa, and Western and Central Asia? These questions tackle the complex interplay of key factors shaping the D4Ag landscape while highlighting areas for further analysis.

Figure 2: The sum of digital deployments launched per region in the last 5 years.

Note: The sum of total deployments is independent of the sum of digital solutions as one solution can be deployed in multiple countries. For example, the digital solutions by Cropin are headquartered in India however are deployed in over 56 countries globally.

Examining trends in solution deployment trends between 2019-2023

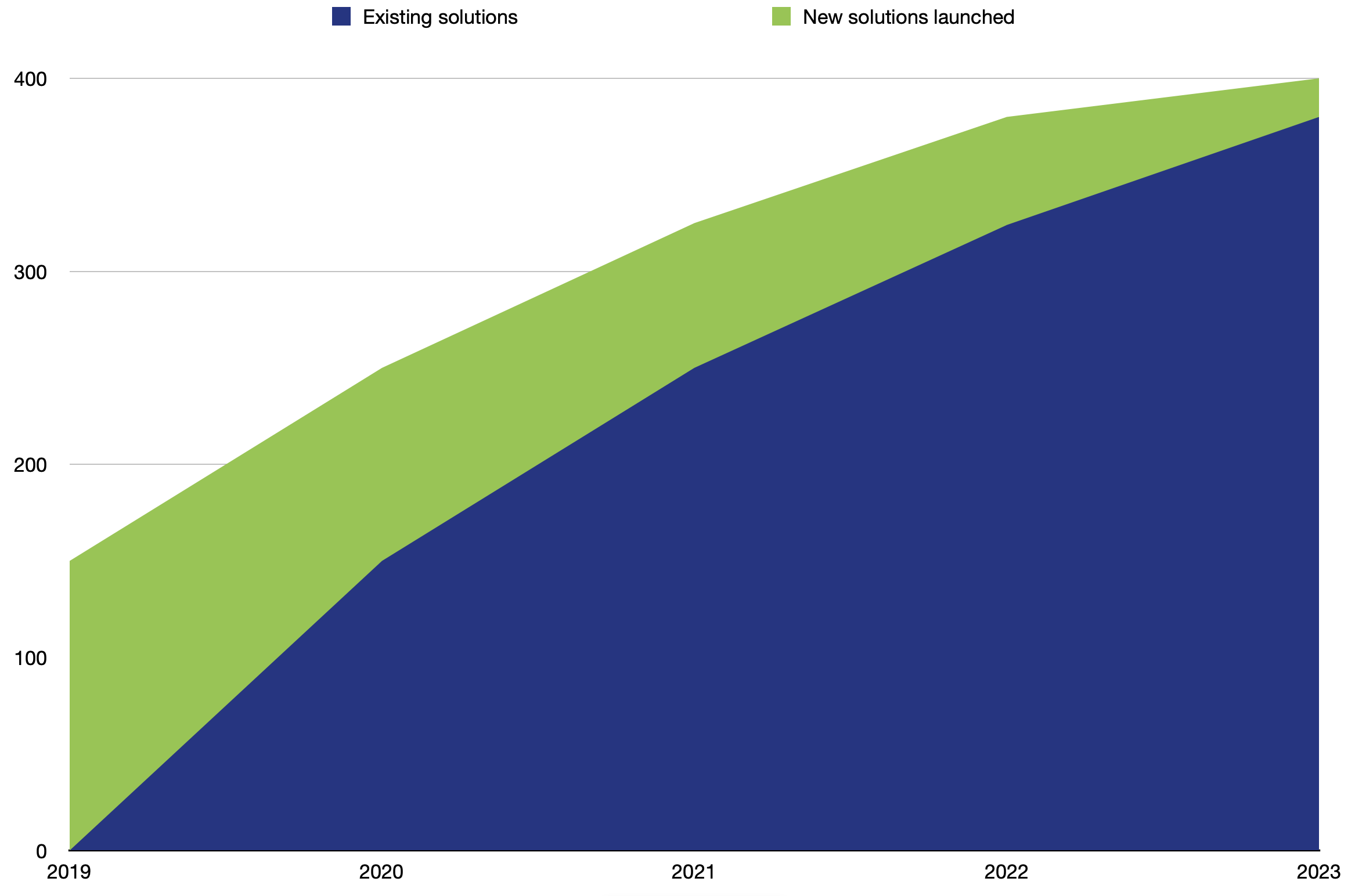

A closer look at the data on solution deployment reveals interesting insights into the evolving D4Ag landscape. The data presents a compelling narrative of decreasing growth in the number of new solutions launched annually within the digital agriculture (D4Ag) sector. In 2019, 146 solutions were introduced, followed by 105 in 2020, 76 in 2021, 60 in 2022, and 15 in 2023. This progression underscores the maturation of the D4Ag sector, spotlighting the growing significance of the Digital Agri Hub.

Figure 3: Number of solutions launched between 2019-2023.

Several factors could contribute to this slowed growth. As the D4Ag sector matures, the imperative for relentless innovation may diminish, with existing solutions evolving to meet market demands. Moreover, the visibility of new solutions plays a pivotal role. Many innovative solutions, while in development, may not immediately reflect in deployment numbers due to the time required to gain recognition and traction. Furthermore, the sustainability of solutions emerges as a critical factor. Not all innovations prove viable in the long run, facing challenges in establishing sustainable business models or achieving scalability. This reality underscores the importance of not only innovation but also resilience and adaptability within the D4Ag ecosystem.

In essence, the evolution of solution deployment trends between 2019 and 2023 encapsulates the dynamic interplay between innovation, market dynamics, and sustainability within the digital agriculture sector. It highlights both the progress made and the challenges ahead, inviting stakeholders to navigate the evolving landscape with insight and foresight.

Analysing trends in phasing out/removing digital solutions launched over the years

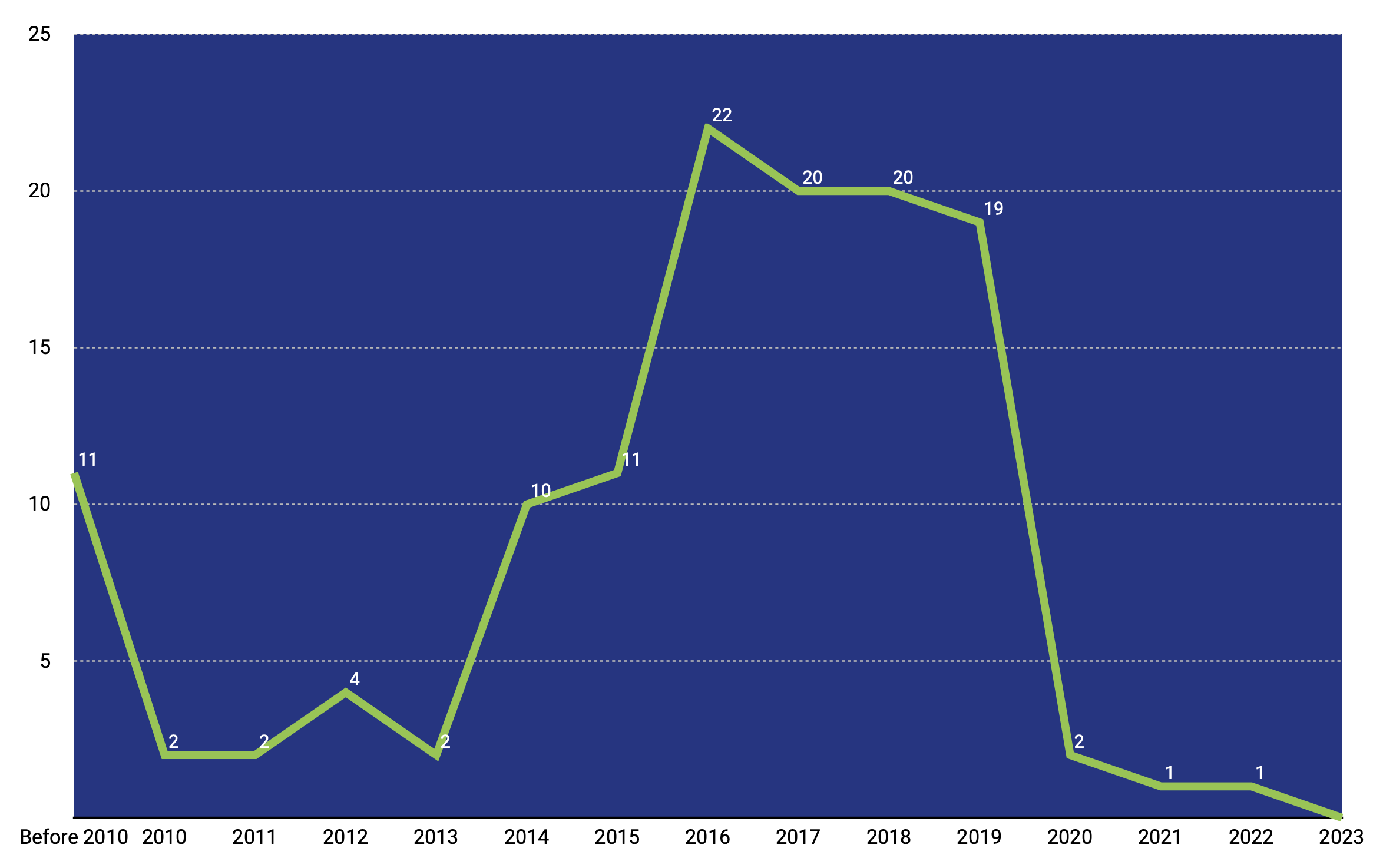

Understanding the trends in the phasing out or withdrawal of digital solutions launched over the years is crucial as we unpack the sector’s evolution. Figure 4 paints a picture of this process, depicting a total of 113 solutions that have been removed or ceased operation since their launch. While this may appear to be a setback, this natural part of the evolution process offers valuable lessons for future developments. The reasons behind the phasing out or removal of digital solutions in the D4Ag sector are diverse and multifaceted. From lack of long-term commercial viability and failure to generate sufficient revenue to sustain their operational costs, leading to being phased out. Another contributing factor is the reliance on term-based donor funding. Many D4Ag digital solution startups depend on donor funding, which may cease once the funding term expires. Without a sustainable business model in place, these solutions may find themselves unable to continue operating. Furthermore, inadequate data and digital infrastructure in certain regions can pose significant challenges to the deployment and operation of digital solutions, prompting their withdrawal. Similarly, the absence of supportive national-level digital policies can hinder their operation and scaling, ultimately leading to their removal from the market.

In addition, the highly competitive nature of the D4Ag sector means that newer and more efficient solutions are constantly emerging. Solutions that fail to keep pace with this competition may find themselves phased out in favour of more innovative alternatives. Moreover, evolving market needs over time can render certain solutions obsolete if these fail to adapt accordingly. As the landscape shifts and demands change, solutions must evolve or risk becoming irrelevant.

Figure 4: Total number of solutions removed (a reference to their year of launch) from the dashboard of Digital Agri Hub

Furthermore, the analysis of solution deployment and phasing out patterns reveals crucial dynamics within the D4Ag sector. Reading between the lines from Figure 3 and Figure 4, it is clearer that the number of new solutions launched annually has shown both an initial steady and more recently a withering growth, and the withdrawal of solutions from the market offers valuable lessons for future developments. Understanding these trends not only sheds light on the rapid evolution of D4Ag but also informs strategies for enhancing the sustainability and effectiveness of digital solutions in addressing agricultural challenges worldwide. Moreover, the regional discrepancies in D4Ag deployment and phasing out across different regions can be attributed to several factors. Firstly, digital infrastructure plays a role. Regions with robust digital infrastructure, including internet access, availability of digital devices, and digital literacy, are more likely to have a higher number of D4Ag deployments. Secondly, agricultural practices tend to influence deployment rates. For instance, regions that rely heavily on subsistence farming may have fewer deployments than those with large-scale commercial farming operations. Thirdly, in less-developed regions like Oceania, North Africa, and Western, and Central Asia, the attractiveness of donor organisations to investing in D4Ag depends on factors such as population size, rural engagement in agriculture, and share of the rural population in the country’s GDP. Addressing infrastructure gaps, promoting digital literacy, and tailoring solutions are essential steps to unlock D4Ag’s potential in these regions. Fourthly, government policies and regulations can either facilitate or hinder the deployment of D4Ag solutions. Regions with supportive policies and regulations are likely to have more deployments. Moreover, funding and investment levels can vary across regions. Regions with more funding and investment are likely to have more deployments. Lastly, local needs and challenges drive the number and type of D4Ag deployments. For example, a region facing severe drought conditions might have more deployments related to irrigation and water management.

Future Outlook

As we continue to navigate this dynamic sector, the Hub’s dashboard will remain an invaluable tool for D4Ag value chain actors, providing up-to-date data and fostering collaboration, co-development, and learning. The second phase of the Digital Agri Hub dashboard’s development offers exciting new insights into the D4Ag landscape. The Hub’s team currently aims to explore the pivotal role of data infrastructures in catalysing advancements in agriculture, particularly in low- and middle-income countries (LMICs). This thematic and geographic focus unfolds associated challenges, opportunities, and the strategic framework required for the successful implementation of agricultural data infrastructures. Moreover, Digital Agri Hub is actively creating synergies in digitalisation for agriculture through partnerships and collaborations with other influential organisations and initiatives active in the sector.