Cooperative union turns digital to ease milk procurement in Tanzania

Cooperative union turns digital to ease milk procurement in Tanzania

Author: GSMA

Publish Date: 23 November 2022

In Tanzania’s Tanga region, not far from the country’s business capital Dar es Salaam, Tanga Dairies Cooperative Union (TDCU) is a major buyer of milk from dairy farmers. With an extensive membership of over 6,500 mainly smallholder farmers, TCDU and dairy farmers face a major challenge as current milk production cannot meet the growing demand for dairy products by urban and semi-urban customers. To modernise operations, create efficiencies in the supply chain and support members to increase the supply of milk, TDCU has taken steps to digitise its farmer-facing processes. By doing so, it expects to intensify the production and collection of milk, while improving the livelihoods of dairy producers in the region. TDCU is not alone in this journey. Over the last decade, many crop buyers in low and middle-income countries have implemented digital agriculture solutions to address challenges faced in the procurement of crops. This blog builds on learnings from TDCU’s digitisation journey and explores the business case for buyers with a low level of formality like cooperatives and farmer associations to adopt and scale digital solutions in the agricultural last mile.

Service overview

Dairy procurement and TDCU

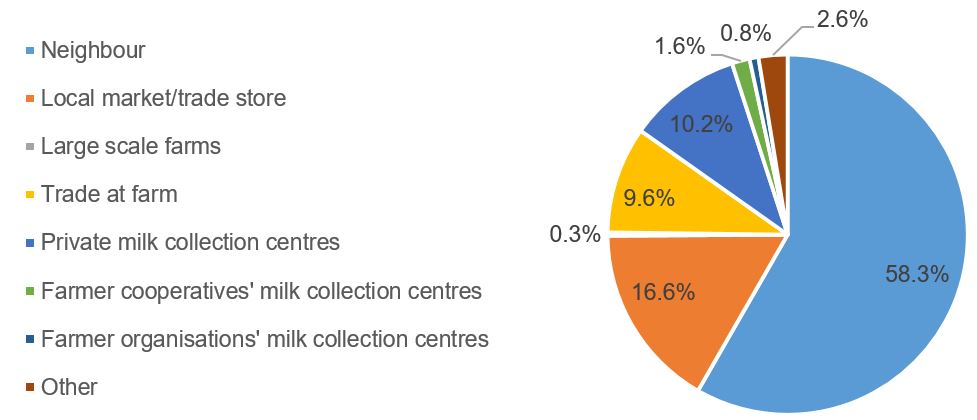

In Tanzania, milk is sold primarily via informal channels with most dairy farmers selling to neighbours, local markets and trade stores. While supply via formal channels is limited, increased consumer demand for dairy products has led to a steady growth of supply via milk collection centres operated by cooperatives, farmer organisations or private entities.

Figure 1. Percentage distribution of milk marketing channels in Tanzania (2019/2020)

Source: Tanzania National Bureau of Statistics. (August 2021). National Sample Census of Agriculture 2019/20 - National Report.

TDCU is the umbrella organisation for 28 primary cooperative societies (PCS) whose membership base consists mainly of smallholder farmers. PCS manage the collection of milk via 42 milk collection centres and are responsible for making bi-monthly payments to farmers. PCS, also known as AMCOs (Agricultural and Marketing Cooperatives Societies), play a crucial role in organising farmers by supporting them through various phases of the agricultural cycle, from production, to processing, transporting and marketing of crops.

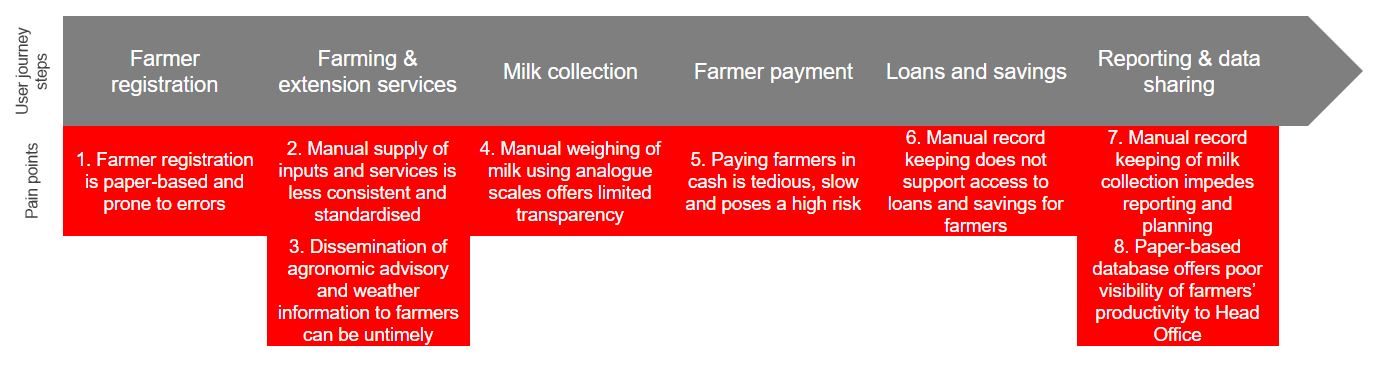

TDCU is a majority shareholder (43.5 per cent) to Tanga Fresh, the main milk processor and producer of dairy products in the region. Milk from the collection centres is delivered daily to the Tanga Fresh factory. Currently, milk supply is insufficient to meet the processing capacity of the plant. TDCU faces many pain points at various steps across the agricultural last mile. As a result, it faces an overall lack of visibility and transparency in last mile operations, challenges in farmer registration and milk collection, and poor support to farmers along the process.

Figure 2. TDCU’s paint points in the agricultural last mile

Source: GSMA

The pain points experienced by TDCU also affect its farmer base. Dairy farmers suffer from poor access to credit that would allow them to invest in agricultural inputs (e.g. quality feed) and improve the supply of milk throughout the year. They also have limited knowledge of best practices in livestock management and zoonotic diseases. To address its own challenges and the challenges experienced by its farmers, TDCU partnered with GSMA and other organisations to develop digital agriculture solution M-Kulima.

Service description

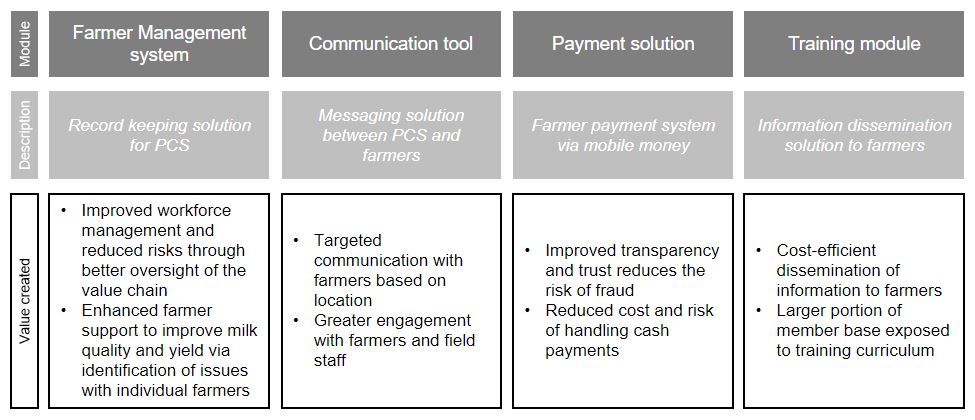

TDCU implemented the M-Kulima last mile digitisation solution in partnership with Tanzanian MNO Vodacom, the country’s leading MNO by market share and owner of mobile money service, M-Pesa. M-Kulima is a continuation of Connected Farmer Alliance (CFA), a multi-year programme between USAID, Vodafone and TechnoServe that was set to develop and scale mobile applications for farming communities and crop buyers. The M-Kulima solution consists of multiple modules in English including a farmer management system, a communication tool, a mobile money-based solution for business-to-farmer payments using M-Pesa, and a training module that provides information on agronomic best practices.

Figure 3. Modules of M-Kulima digital solution used by TDCU

Source: GSMA, TDCU

Strategic goals

When sourcing milk from farmers, TDCU engages in a variety of activities, such as monitoring operations in the last mile, making payments to farmers, managing end-to-end traceability of milk and rolling out field training. M-Kulima gives TDCU greater control over its operations and improves business performance. The business case for rolling out the M-Kulima solution is further strengthened by TDCU’s key strategic goals to promote farmer loyalty (ensuring farmers return to sell to the agribusiness) and support the professionalisation of farmers (e.g. enable access to high-quality agri-related advisory services).

Business model

As an organisation operating in a value chain with a low degree of formality, TDCU requires a “patient business model” while it seeks to digitise its operations. Working with a consortium of partners under the GSMA Innovation Fund for Digitisation of Agricultural Value Chains has allowed TDCU to benefit from the technical expertise of specialist organisations and to use philanthropic capital to de-risk investment. This has also allowed it to test and iterate the digital solution before pursuing scale.

Key benefits of a consortium approach

For TDCU, a major benefit of participating in the Innovation Fund consortium has been the opportunity to accelerate its digitisation journey. TDCU opted not to develop a last mile digital solution in-house. Using an off-the-shelf service such as M-Kulima has allowed the cooperative union to rapidly deploy a digital solution while still retaining the ability to customise it to its needs.

Under the consortium, the GSMA provides risk capital in the form of a grant and a comprehensive package of targeted consultancy covering a range of areas such as user experience research; business intelligence; monitoring, evaluation and learning; product and project management. These services are available during the Innovation Fund grant period and address the lack of technical expertise by TDCU. They enable continuous product iteration and allow partners to understand how users are interacting with the service, whether their needs are being met and if they are deriving any benefits from what is on offer.

Key activities to boost adoption

TDCU is currently deepening its understanding of operational pain points, while building own and farmers’ digital expertise to improve the adoption of the digital service. The effort to digitise PCS activities is significant primarily due to low levels of technological literacy that is affecting the adoption of the M-Kulima solution by TDCU and farmers.

Low literacy impacts various steps in the digitised user journey and poses a barrier to the success of the service. It determines the use of M-Kulima solution by TDCU field agents and affects the processing of mobile money-enabled payments to farmers. To overcome this risk, TDCU is heavily involved in capacity-building directed to both its own staff, such as field agents and office staff, and to farmers. For example, TDCU is involved in the training of PCS on M-Pesa and M-Kulima use; collection centre staff on digital farmer profiling and milk collection; and farmers on accepting procurement payments digitally. The capacity building activities of staff and farmers can be time consuming and costly to run; however, they are essential in the adoption of the digital solution.

Besides training, TDCU is also involved in a range of other activities planned by the product manager and project partners and aimed at supporting the product development process. For instance, TDCU coordinates the sensitisation of farmers to support account activations and training; provides administrative support to allow the roll-out of the digital solution; and supervises PCS and extension officers as they transition to digital technologies. These activities are critical to the success of the digital procurement solution.

Future outlook

As the Innovation Fund grant will soon come to an end, TDCU is evaluating with consortium partners, the strategic plans and future direction of its last mile digitisation initiative. Achieving scale will allow TDCU to extend the benefits of digitisation to the entire farmer base. Crucially, it will allow it to evaluate project success against business objectives by answering key questions such as:

- Has digital profiling of farmers allowed TDCU to become more responsive to farmer needs, improve services to members and increase the supply of milk?

- Has the roll-out of the digital solution resulted in reduced costs for the delivery of agricultural extension services to farmers?

- Has the transition to mobile money-enabled business-to-farmer payments reduced the cost and risk of dealing in cash?

Looking ahead, TDCU and partners will need to identify a viable business model for the service that will allow them to continue operating after the end of the grant period. For this to happen, a clear value proposition will have to exist for all project stakeholders – farmers included.

Presenting the experience of TDCU, this blog has highlighted the business case for last mile digitisation for organisations like cooperatives and farmer associations which show a low level of formality that results in weaker relationships with the producers of crops. While these organisations may face significant challenges in rolling out digital solutions, they offer proof that last mile digitisation is not only suitable to formal crop buyers operating in vertically integrated value chains. Project challenges and resulting activities may vary, however, advances in the adoption of digital technologies by agriculture stakeholders, better access to agritech innovations, improved and more affordable connectivity and improving digital literacy among smallholder farmers offer a pathway to digital adoption from a broad range of crop buyers.